unemployment tax forgiveness pa

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. If none leave blank.

Are You Eligible For The Pa Tax Amnesty Program Alloy Silverstein

31 for workers who earn less than 4000 every two weeks according to the memorandum.

. If Line 13 is. Box 67503 Harrisburg PA 17106-7503. 10200 tax break President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020.

Report the Acquisition of a Business. To claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SP. Get Information About Starting a Business in PA.

Employers Tax Services. Appeal a UC Contribution Rate. If you are married each spouse receiving unemployment.

Verifying your eligibility for Tax Forgiveness based on income tables and what forms to fill out if you qualify. File and Pay Quarterly Wage and Tax Information. As it stands the American Rescue Plan Act of 2021 which sets out to provide relief to individuals who received unemployment compensation in 2020 there is an exclusion cap up to 10200 dollars of.

Apply for a Clearance. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. All payments should be sent to Office of UC Benefits Policy UI Payment Services PO.

Taxpayers may only claim dependents who are minor or adult children claimed as dependents on their federal income tax returns. Pandemic Unemployment Assistance PUA Login to the PUA system to file a claim or weekly certification. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

Subtract Line 13 from 12. A new law allows most individuals to be exempt from paying taxes on the first 10200 received in the various federal disaster aid programs including the 345 a week from Pandemic Unemployment Assistance and the additional weekly 600 of Federal Pandemic Unemployment Compensation and the extra 300 a week through the Lost Wages Assistance. This deferral does not apply to Pennsylvania personal income tax withholding.

In Part D calculate the amount of your Tax Forgiveness. Register for a UC Tax Account Number. Further to qualify for the credit it is necessary to calculate both the taxable and nontaxable income.

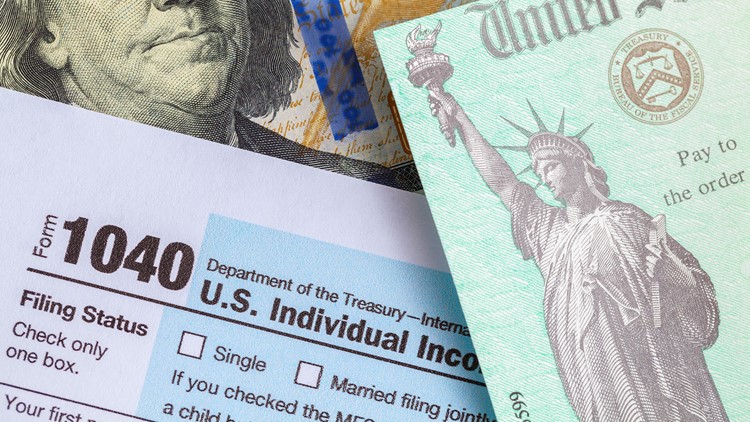

Tips for Tax Forgiveness. You should receive a 1099-G reporting the unemployment compensation you received during 2021 to be reported on your 2021 Return in 2022. Under the Biden Stimulus ARP package which funded another round of unemployment benefit extensions there was a late provision added that provided a tax break on unemployment insurance UI benefits.

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. It is not an automatic exemption or deduction. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income.

Change My Company Address. Grey Owl by Zdenek Machácek. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents if any.

Provides a reduction in tax liability and Forgives some taxpayers of their liabilities even if they have not paid their Pennsylvania personal income tax. Access UCMS and find information about starting or maintaining a business in Pennsylvania. For PA purposes qualifying children include parents natural children adopted children and step-children.

Learn about Pennsylvanias UC program how to apply maintaining eligibility and more. Record tax paid to other states or countries. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Register to Do Business in PA. First figure out your eligibility income by completing a PA-40 Schedule SP. Record the your PA tax liability from Line 12 of your PA-40.

Qualified children also include grandchildren of grandparents and foster children of. This tax break exempted the first 10200 in unemployment benefitscompensation received in 2020 not in 2021. Unemployment compensation is taxable income which needs to be reported by filing an income tax return.

Enter the figures from your form on. Although they file their PA tax returns separately Tax Forgiveness requires them to use the married claimants table and report their total joint eligibility income on their separate PA Schedules SP. With total eligi-bility income of 38000 Charla who claims the three dependents uses Table 2 and qualifies for.

People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation. Learn More About UCMS. These benefits are not taxable by the Commonwealth of Pennsylvania and local governments.

Your eligibility income is different from your taxable income. Unemployment Income and State Tax Returns. Congress hasnt passed a law offering.

Verify Identity with IDme. This means they dont have to pay tax on some of it. In March 2020 Pennsylvania passed legislation requiring employers to give certain information to claimants who are separating from their employment for any reason.

The purpose is to cut down on the wasted time and resources due to claimants who do not enter correct employer information when they open an unemployment claim. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such tax. Employers should continue to withhold Pennsylvania personal income tax from each payment of taxable compensation to their.

The deferral is in effect from Sept. You may also use your Visa MasterCard Discover or American Express card to make a payment on the departments convenient and secure online payment site.

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Wnep Com

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Wnep Com

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post